Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

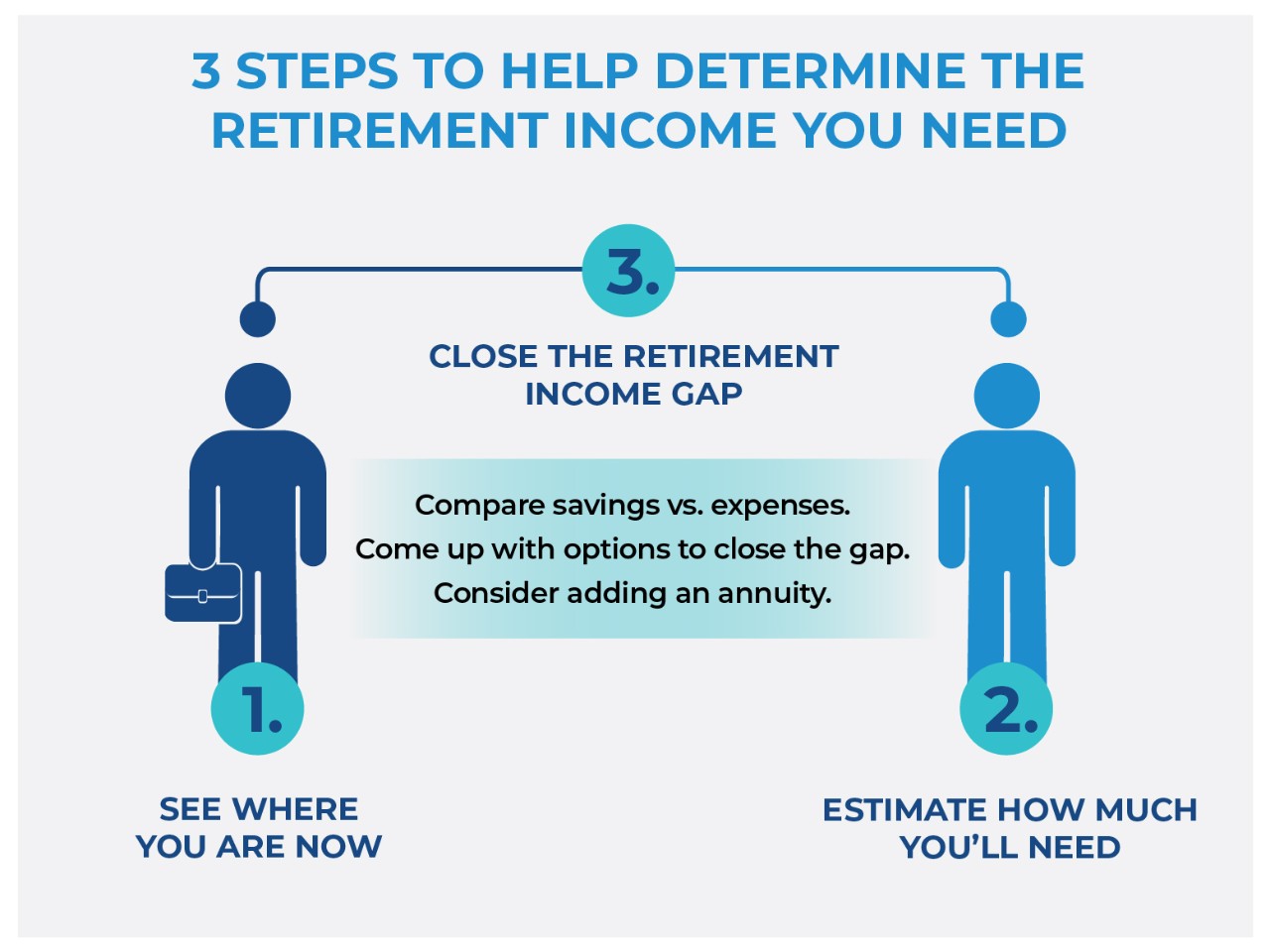

Following these steps can help you save enough money to make your retirement dreams come true.

It can be fun to dream about the retirement you want. But turning those dreams into reality means planning ahead and digging into your finances to see where you are today and how much retirement income you’ll need, then determining a strategy to get you there.

Start with your current situation

While it may be interesting to take stock of your entire financial picture, for this exercise you’ll want to focus solely on your retirement savings or money you’ve set aside specifically for retirement income. For most of us, that would include money in a 401(k) or 403(b) plan through your employer or money you’ve contributed to a traditional or Roth IRA. If you have a high deductible health insurance plan, you may even have access to a Health Savings Account (HSA) that can allow you to save additional money for retirement if you don’t need it to pay for medical expenses now.

Once you’ve added up how much you currently have set aside for retirement income, take a look at how much more you’re adding to those accounts each year and how many more years you expect to work before you retire. Some employers will match a certain percentage of your retirement plan contributions. This is free money, so make sure you’re contributing at least that amount if you can. Even one percent more each year can add up over time. If you are self-employed, consider talking to your accountant about how much you can contribute to an Individual Retirement Account (IRA) each year.

You’ll also want to consider how your money is invested, since that will play a big part in determining how much or how little it grows over time. Talk to a financial professional about how much investment risk you’re willing to take and specific strategies that may help you invest your money to meet your retirement income goals. Everyone is different, so just because your co-worker invests in XYX mutual fund, doesn’t mean you should.

Estimate a retirement budget

Putting together a budget can help you figure out how much retirement income you might need to live comfortably when you’re no longer working. Start with the expenses you have now, eliminate those you won’t have in retirement (like contributions to a retirement plan or costs to commute to work), then add in those you don’t have now but might have later (like travel or hobbies). Obviously, this budget won’t be exact, but it may help you see how much you might need each year once you’re retired. Keep in mind that inflation may also increase your cost of living. Then, take a guess at how long you expect to live and add up how much retirement income you’ll need over the years.

Determine how to close the retirement income gap

Now, compare how much you think you’ll need in retirement vs. how much you will have saved. If those numbers don’t line up, that’s okay. You now have a place to start closing the retirement income gap. Consider your options and get creative. Some options might be as simple as saving a bit more money each year in your retirement plan or taking out a life insurance policy that also has the potential to build cash value (like universal life insurance) if you need death benefit protection. You might invest in real estate that you can later rent out to others, potentially giving you a passive income stream. Once you retire, you might downsize your home, or start a side business that can provide you with additional retirement income.

You may also receive Social Security or pension benefits, so you can add those into the “will have” side of your retirement income equation.

Using an annuity to help plan for retirement income

Besides Social Security and pensions, annuities are one of the only financial products that can provide you with lifetime retirement income payments. With an annuity, you can use a set amount of money to turn into a stream of payments that can last as long as you live, or even as long as both you and your spouse live. Knowing you’ll have a specific amount of guaranteed income may help you plan your retirement income and your budget more accurately. Talk to your financial professional about your situation and if an annuity might be a good fit for you.

READ MORE

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

Pacific Life, its affiliates, their distributors and respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life refers to Pacific Life Insurance Company and its subsidiary Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company and in all states by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

PL75