Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Three important questions to ask before you reach retirement age.

Over your working years, you’ve been diligently saving and investing for the future. As you get closer to retirement, though, you may be wondering if you’ll have enough to live comfortably and how you’ll turn those assets into a stream of retirement income payments that can replace the paycheck you’re getting now. Generating retirement income takes some planning. Working with a financial professional to answer these questions can help you get started.

How much retirement income will you need?

Some financial professionals believe that you’ll need around 70-80% of your current income in retirement. But that will depend on how you live and what you do once you’re retired. If you pay off your mortgage before you retire, no longer need a wardrobe of work clothes, or won’t have commuting costs, you may need less. But, if your retirement plans include lots of traveling and other expensive hobbies, you may need retirement income that is closer to what you’re making now. Consider putting together a retirement budget and comparing it to your costs now. Which expenses will go away when you retire? Which expenses might increase?

Where will your retirement income come from?

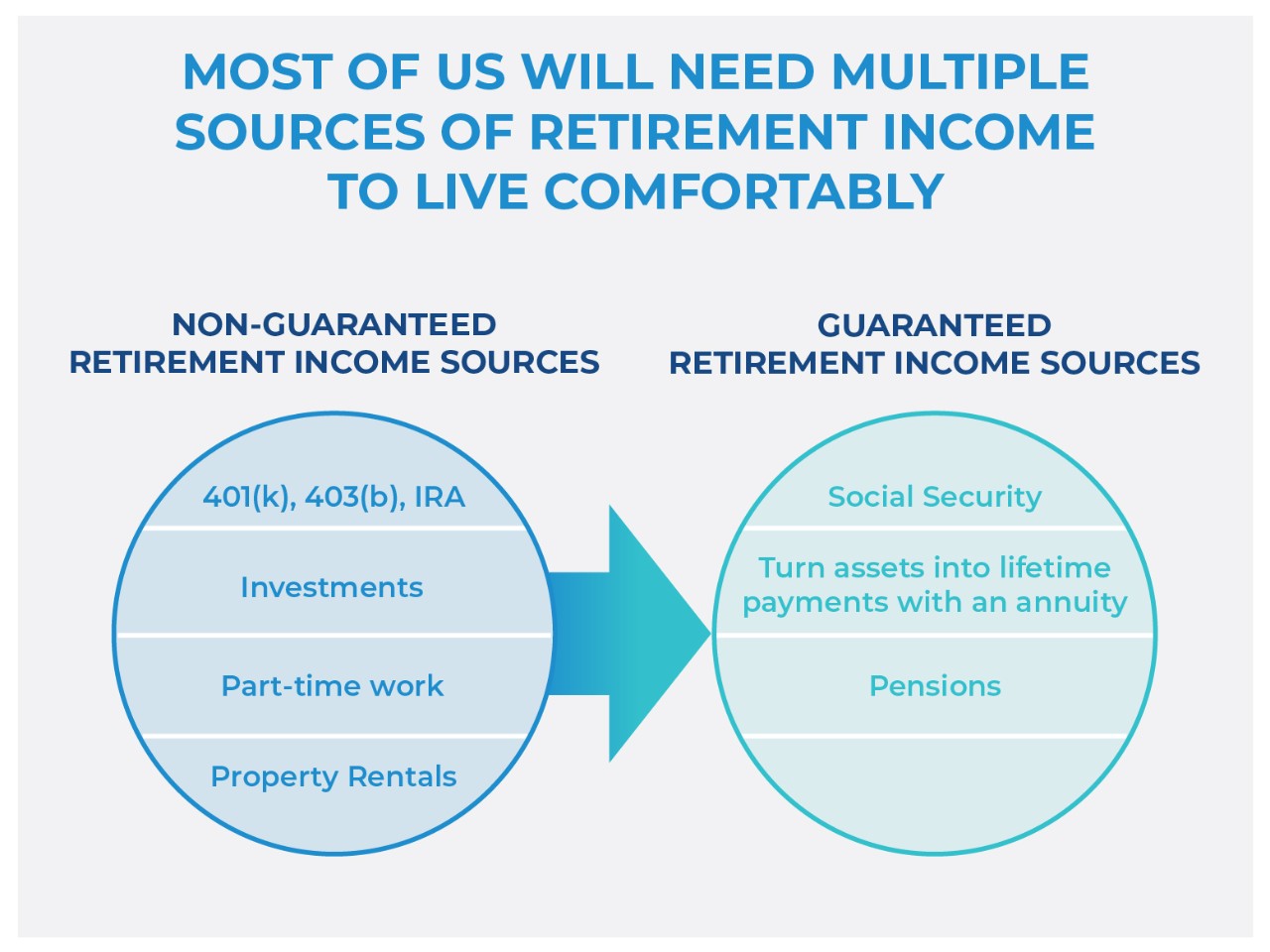

Once you understand how much money you’ll need, it’s time to figure out where your retirement income will come from. Most of us will have both guaranteed and non-guaranteed income sources.

Guaranteed sources of retirement income can include Social Security or employer-provided pension plans.

If you’re paying into Social Security now, you’ll likely get benefits once you reach retirement age. To find out how much you might expect from Social Security, visit ssa.gov and request a Social Security Statement or sign in or create an account to see how much you can get depending on when you apply for benefits (between the ages of 62 and 70). Typically, the longer you wait, the more you’ll receive per month, though once you reach age 70, your benefits will no longer increase.

While over 85% of state and local government workers have access to a pension (also called a defined benefit plan), just 15% of private industry employees do.1 And even those who get a pension might not receive as much retirement income as they need. That leaves non-guaranteed sources of income to foot a good share of the retirement income bill.

Non-guaranteed sources of retirement income may include investments, defined contribution plans such as 401(k)s, 403(b)s or IRAs, as well as savings. Most of us will need to rely heavily on these types of income to live the life we want in retirement. You can always look for other ways to increase your retirement income too, such as part-time work or rental properties.

How will you turn assets into retirement income?

Once you’re ready to retire, you will need a stream of income payments to live on, much like the paychecks you may receive now from your employer or business. Two ways to do this are by taking systematic withdrawals or by investing part of your assets in an annuity.

Systematic withdrawals help you to keep control of your money, determine how much you’ll take each month or year, and continue to invest the remainder. However, with these types of withdrawals, you may also risk running out of money, as there is no guarantee that your retirement income will last as long as you live.

On the other hand, using a portion of your retirement savings to purchase an annuity is a way to guarantee income for life. If, for example, you purchase a fixed annuity 10 years before you retire, that money can grow at a fixed rate, and you can utilize those assets to produce a guaranteed stream of retirement income payments that you cannot outlive.

Many of us may benefit from a combination of systematic withdrawals and an annuity for retirement income. You could, for example, pay fixed costs such as living expenses, food, and insurance with the guaranteed income, and take withdrawals from your investments to cover variable costs such as travel, gifts, and unexpected expenses.

If you have retirement plans such as a 401(k), 403(b), or IRA, you will need to take what’s called Required Minimum Distributions (or RMDs) once you reach age 73 (or age 75 if born after 1959). If you don’t take the full RMD each year, you will have to pay an additional tax penalty on top of the taxes you’re already paying on the withdrawal.

Next steps

Your financial professional is also a great resource to help you plan for the future and decide which type of retirement income strategy best fits your needs and goals.

READ MORE

1 U.S. Bureau of Labor Statistics, Retirement benefits: Access, participation, and take-up rates for defined benefit and defined contribution plans, March 2023, access June 2024

In order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

Pacific Life, its affiliates, their distributors and respective representatives do not provide tax, accounting or legal advice. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor or attorney.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life refers to Pacific Life Insurance Company and its subsidiary Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company and in all states by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

PL74