Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

-

Individuals

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

-

Employers

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

-

Institutions

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

-

Financial Professionals & Brokers

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

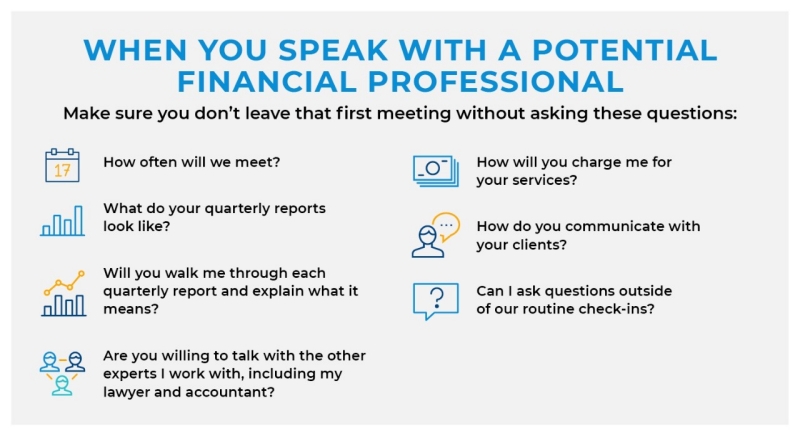

When searching for the right financial professional for you, start with these 7 questions.

According to a 2021 study by The Harris Poll1, 53 percent of Americans say one of their top goals for the year was going to be related to their finances. As American society faces an undetermined future, financial professionals have a new opportunity to boost services for existing clients and prove their value to financially underserved consumers. Yet financial professionals are not one size fits all. They have a wide range of investment philosophies, communication styles and ways of charging clients. This diversity can make it difficult to choose a financial professional who meets your needs. But it doesn’t have to. You just need to know what to look for, and the right questions to ask.

Are they qualified?

The most common professional designations you’re likely to encounter in your search are CFP®2 (Certified Financial Planner™) and CFA®3 (Chartered Financial Analyst®). A CFP’s skill set is geared toward total wealth management, including debt consolidation, portfolio management, retirement savings and estate planning. A CFA®’s skill set is more specifically focused on managing financial portfolios for individuals and businesses. A financial professional must also be a state-licensed life insurance producer and appointed to sell life insurance products.

If you’re considering working with a financial professional who promotes variable products, like variable annuities, variable life insurance and mutual funds, it’s a good idea to check their employment history and determine whether there have been investment-related, consumer-initiated complaints or arbitrations against them. (Bear in mind that not all complaints or arbitrations are reportable.) Any financial professional registered with the Financial Industry Regulatory Authority can be checked through BrokerCheck.

Are they a good fit for you?

Most financial professionals you research will do a fine job assisting you with your assets. But a great financial professional will take time to truly dig into your financial goals and help you build a plan to pursue them. Look for a financial professional who makes you feel comfortable and who will really learn the complexities of your financial situation.

Also consider whether the financial professional’s communication style is a good match for you. Do they explain things in a way you comprehend? Ask to see samples of the quarterly reports they send to clients. These documents may tell you a lot about how the financial professional communicates with clients.

For instance, some financial professionals may not send much more than the amount of your total assets and how much you’ve earned since the last quarter. Others may send detailed reports with charts describing your asset mix, their rationale and an overall assessment. Whatever type of report they offer, it should be one that you understand and that contains the type of information you’re interested in.

And about that fine print …

Before you begin working with a financial professional, make sure you know all the details about how they get paid. Fee-based financial professionals will usually charge a percentage of the assets they oversee for you.

Commission-based financial professionals will not charge you a fee. For life insurance products without variable investment options, their commissions are paid by the companies issuing the products they sell, so there’s no out-of-pocket cost to you.

For products with variable investement options, commissions to the financial professional may have to be paid by the client through the underlying investments in addition to the commission paid by the insurance company.

The bottom line: Ask questions

When you meet a financial professional, be open about your questions and concerns. Someone who answers your questions clearly and to your satisfaction may be just the right fit to help you reach your financial goals.

READ MORE

Retirement Planning

Talking Social Security With Mary Beth Franklin

Staying aware of current regulations set by the Social Security Administration can help retirees receive the full benefits they deserve.

Retirement Planning

Optimizing Social Security Benefits with Mary Beth Franklin

Women and other minorities can optimize their strategies for claiming Social Security retirement benefits by keeping a few key ideas in mind.

Retirement Planning

The Financial Pillars of Retirement with Mary Beth Franklin

Many people underestimate the importance of financial security in building an emotionally fulfilling retirement.

Retirement Planning / Family

How Annuities Can Boost Your Retirement Savings

The tax-deferred growth potential of an annuity can boost your savings for the future.

Retirement Planning / Family

How to Enhance Your Retirement Strategy with Cash Value Life Insurance

Your retirement strategy should begin with a tax-advantaged retirement account, but it doesn't have to end there. Supplementing your 401(k) or IRA with cash value life insurance can help give you greater financial flexibility during your lifetime while providing protection to your loved ones.

Family / Estate Planning

What Blended Families Should Know About Estate Planning

An estate plan with an Irrevocable Life Insurance Trust may help reduce estate taxes and ensure equitable distribution of a blended family’s assets.

Family / Estate Planning

Ensuring a Smooth Transition for Your Family Business

A plan that includes life insurance can help provide liquidity and equality in a family business succession.

Home / Estate Planning

How to Help Protect Your Estate Plan from an Uncertain Future

A life insurance trust can help provide flexibility and protection for the future.

Family / Estate Planning

Estate Planning for Unmarried Couples

Life insurance can help maximize wealth transfer for unmarried couples.

Family / Estate Planning

5 Ways Life Insurance Can Help With Estate Planning

As you develop or update an estate plan, considering the following ways life insurance can help address your needs.

Career And Business

Retirement Savings Options at a New Job

Weigh your choices before deciding where—or whether—to move your retirement savings when you switch employers.

Retirement Planning

Ways to Retire Confidently

If you’re concerned about saving enough for retirement, a protected source of income can help put your mind at ease.

Retirement Planning / Home

Don’t Put Off Saving for Retirement

Start building your nest egg early to prepare for the unexpected.

Retirement Planning / Family

Managing Your Beneficiaries’ Inheritance

An annuity with a predetermined beneficiary payout option can offer greater control without a trust.

Retirement Planning

How to Save on Charitable Giving During Retirement

Qualified charitable distributions can help with tax savings and at the same time give to charity during retirement.

Retirement Planning

Picking the Right Type of IRA for You

Understanding the difference between a traditional and Roth IRA can go a long way in planning your retirement savings strategy.

Estate Planning / Family

How to Cope Without the Family Breadwinner

Take these steps to help your loved ones prepare financially in the event the worst happens to you.

Career And Business / Family

A Smart Way for Philanthropists to Give More

A well-designed charitable remainder trust can help lower taxes and aid in financial planning.

Retirement Planning

The Challenges of Living Longer

The good news: Retirees are living longer. The bad news: That may mean retirees will have to fund more years of retirement.

Retirement Planning

Make the Most of Your Retirement With an Informed Income Strategy

Annuities offer another way to put a floor under your retirement income, providing an retirement income stream in exchange for an initial investment. Immediate annuities begin issuing payments soon after you make your investment, while deferred annuities are invested for a period of time before you start taking withdrawals. You can also choose between fixed (-rate) and variable annuities. Fixed annuities earn a guaranteed interest rate over time, while variable annuities are tied to the performance of an investment portfolio. Both provide monthly income for life and protection for your loved ones through a death benefit.

Estate Planning / Family

Finding a Way to Hand Over a Family Business

Creating a detailed succession plan is paramount for a smooth and profitable transition.

Family / Retirement Planning

Balancing the Care of Aging Parents and Children

There are ways to ease the burden of this high-stress juggling act.

Retirement Planning

Deciding When to Claim Retirement Benefits

Keys to Optimizing Social Security Income.

Home

How Tax Reform Impacts Retirement and Estate Planning

The new tax law will alter many decisions you may have to make when filing your 2018 taxes.

Retirement Planning

The Importance of Investment Diversification

Methodically placing assets in several baskets isn’t as thrilling, but helps you invest responsibly.

Estate Planning / Family

Protect Your Loved Ones With an Estate Plan

Taking a proactive approach to passing on your assets can help bring peace of mind to you and your family.

Retirement Planning / Home

Choosing a Financial Professional

When searching for the right financial professional for you, start with these 7 questions.

Retirement Planning / Family

Four Ways to Access the Value of a Life Insurance Policy

Life insurance isn’t only for your survivors: Find out how to use its cash value during your lifetime.

Retirement Planning

Women & Finances: Securing Your Retirement

Strategies to help make sure your retirement savings last for life.

Retirement Planning / Family

Women & Finances: Strengthening Your Finances After Divorce

Make sure your retirement plan is still on track.

Family / Home

Women & Finances: Moving Beyond the Loss

The loss of a significant other can offer an opportunity to learn about financial empowerment.

Retirement Planning

Weathering a Turbulent Market

Worried investors would do well to remember that historically, markets recover after a downturn.

Family / Home

The Surprising Affordability of Term Life Insurance

A life insurance policy isn’t as expensive as you think.

Family / Home

Get the Most Out of Your Annual Financial Check-Up

A yearly financial review is a good way to stay fiscally healthy.

Retirement Planning / Family

How to Buy an Annuity

Choose the right annuity plan that aligns with your financial goals.

Family / Home

6 Life Insurance Myths Debunked

Don’t let these common misconceptions prevent you from giving your family the protection they deserve.

Healthcare / Family

Planning for the Cost of Healthcare in Retirement

Trying to anticipate what you’ll spend on healthcare in retirement can seem daunting, but estimates can help you start preparing for the future.

Family / Home

The Benefits of Rethinking Work-Life Balance Before Retirement

Achieving better work-life balance now can help position you for a more fulfilling future.

Family / Estate Planning

How to Buy Life Insurance

These four steps can help you choose the best protection for you and your family.

Retirement Planning / Family

How to Lower Your Taxes in Retirement

You’ve worked hard to build your retirement savings. Now, make sure your money lasts by considering strategies to lower taxes.

Home / Family

The Importance of Financial Literacy

Learn about basic concepts regarding financial literacy: budgeting, saving, debt/spending, and financial management.

Retirement Planning / Family

Make the Most of Your Money with a Financial Plan

A financial plan can help you meet your needs today and reach your long-term goals.

Family / Home

Money Moves to Help You Feel More Confident

Build a stronger financial foundation with these four steps.

Family / Home

Supporting Multiple Generations

Tips for families with many generations living together so everyone stays financially healthy.

Family / Estate Planning

Securing Your Family’s Future

Having an estate plan is essential to maintaining your family’s financial security.

Retirement Planning / Family

4 Ways to Help Turn Income Into Wealth

Build your wealth by incorporating these strategies into your financial plan.

Career And Business

Why Employee Benefits Matter

The key to attracting top talent goes beyond trendy perks.

Retirement Planning / Family

How Much Life Insurance Do I Need?

These key factors can help you figure out your life insurance sweet spot.

Retirement Planning / Family

Less Stress More Security

How to reduce anxiety and bolster your retirement with reliable protected income.

Retirement Planning / Family

How to Generate Retirement Income

Three important questions to ask before you reach retirement age.

Retirement Planning / Family

Saving Now for the Retirement Income you Need Later

Following these steps can help you save enough money to make your retirement dreams come true.

Home / Estate Planning

Using Life Insurance and Annuities in Estate Planning

Adding these two financial products could help you achieve your estate planning goals more efficiently.

Family / Estate Planning

Using Life Insurance for Generational Wealth Transfer

Five reasons to consider permanent life insurance for transferring wealth to children or grandchildren.

Family / Home

What to know about Cash-Value Life Insurance

If you’re in the market for life insurance protection, don’t overlook permanent life policies.

Career And Business / Family

How Key Person Life Insurance Can Benefit Your Business

Life insurance for an employee your business can’t live without

1 "MDRT study reveals Americans’ financial priorities after a year of the pandemic and recession", retrieved Oct. 23, 2021

2 A CFP® designation (Certified Financial Planner™) is a professional certification for financial planners that signifies expertise in financial planning and a commitment to high ethical standards, including acting as a fiduciary for clients. To earn the designation, candidates must meet stringent requirements for education, experience, and passing a comprehensive exam administered by the CFP Board, and they are required to complete continuing education and adhere to ethical guidelines to maintain their certification.

3 The CFA® (Chartered Financial Analyst®) Charter is a globally recognized designation that attests to success in a rigorous and comprehensive study program in the investment management and research industry and a commitment to ethical conduct. CFA Charterholders are held to a standard of loyalty, prudence, and care in all our interactions with their clients and must act for the benefit of their clients and place their clients’ interests above their own. They are bound to comply with any legally required fiduciary duty.

Pacific Life is a product provider. It is not a fiduciary and therefore does not give advice or make recommendations regarding insurance or investment products.

Pacific Life refers to Pacific Life Insurance Company and its subsidiary Pacific Life & Annuity Company. Insurance products can be issued in all states, except New York, by Pacific Life Insurance Company and in all states by Pacific Life & Annuity Company. Product/material availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Insurance products and their guarantees, including optional benefits, annuity payout rates, and any crediting rates, are backed by the financial strength and claims-paying ability of the issuing insurance company, but they do not protect the value of the variable investment options. Look to the strength of the insurance company with regard to such guarantees because these guarantees are not backed by the independent broker/dealers, insurance agencies, or their affiliates from which products are purchased. Neither these entities nor their representatives make any representation or assurance regarding the claims-paying ability of the issuing company.

The home office for Pacific Life & Annuity Company is located in Phoenix, Arizona. The home office for Pacific Life Insurance Company is located in Omaha, Nebraska.

| Investment and Insurance Products: Not a Deposit | Not insured by any Federal Government Agency | |

| Not FDIC Insured | No Bank Guarantee | May Lose Value |

PL4D