Retirement is lasting longer

As the length of retirement increases, so does the amount you'll need to live comfortably in those years.

View our infographic for interesting facts & figures about retirement.

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

Discover financial solutions that protect your future and provide peace of mind. Whether you're exploring annuities, life insurance, or understanding employee benefits through your workplace, Pacific Life offers resources and products designed to meet your personal and family goals.

Support your workforce with innovative employee benefits and retirement solutions. Pacific Life partners with business owners, benefits administrators, and pension fund managers to create customized programs that attract and retain top talent while securing their financial future.

Simplify complex retirement and pension risk management with our tailored solutions for large organizations. Pacific Life specializes in working with institutions to address their unique challenges, offering expertise in pension de-risking and strategic retirement planning for a more secure future.

Empower your clients with confidence by leveraging Pacific Life’s comprehensive portfolio of financial products. From annuities to life insurance, we provide the tools, resources, and support to help financial advisors and brokers deliver exceptional value and long-term results.

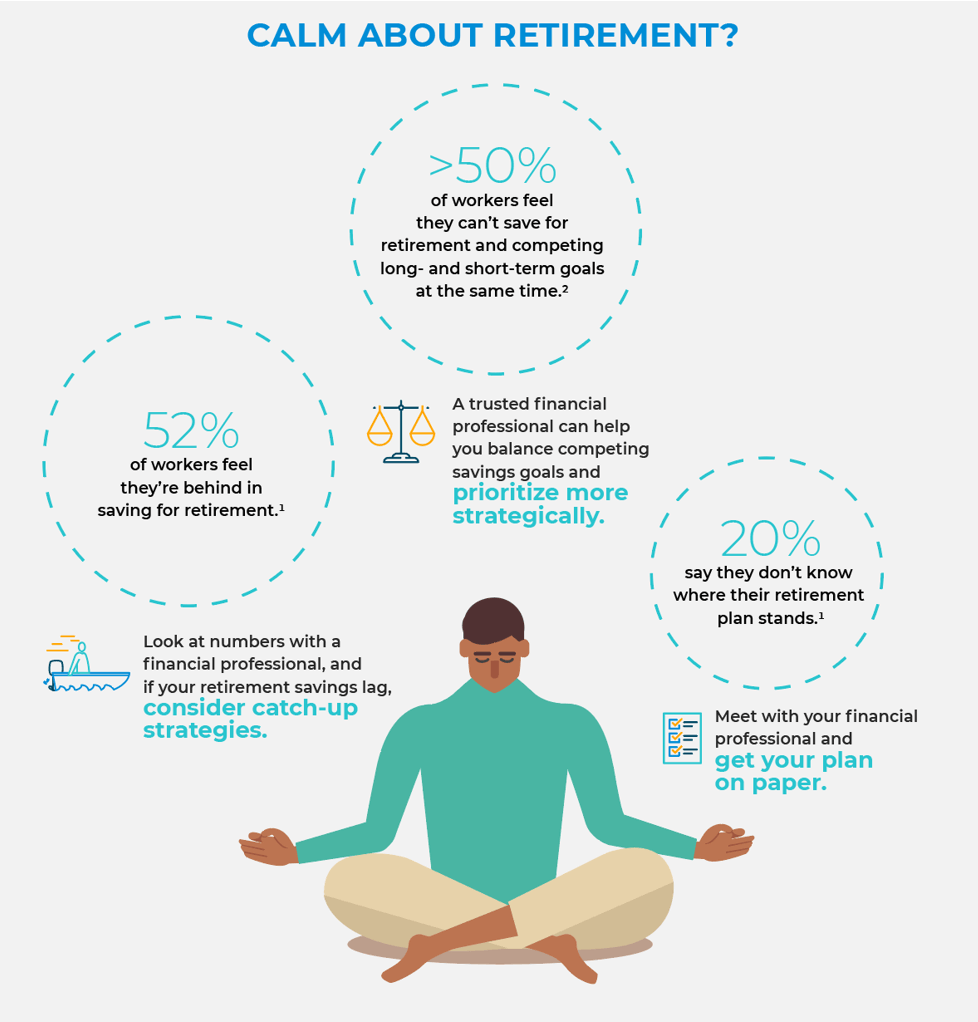

Will my money last through retirement? It’s the question facing most pre-retirees. If you’re not confident in your plan for the future, now is the time to look at solutions that can help ensure that your money lasts as long as you do. From ways to maximize your retirement savings to closing the savings or Social Security benefits gap, we can help. Partner with your financial professional to look down the road. While no one knows how long your savings will stretch, there are ways to help make certain you’ll always have enough.

It’s a matter of creating a holistic plan. Until you look at your specific goals and delve into your particular financial situation, your planning about the future is hypothetical. Remove the uncertainty by determining where you anticipate your retirement income will come from and develop a customized plan to fill any gaps. A financial professional can help you create a retirement income strategy you feel confident about.

1 Bankrate, “More than half of American workers say they are behind in saving for retirement”

2 Employee Benefit Research Institute, “2019 Retirement Confidence Survey Summary Report"

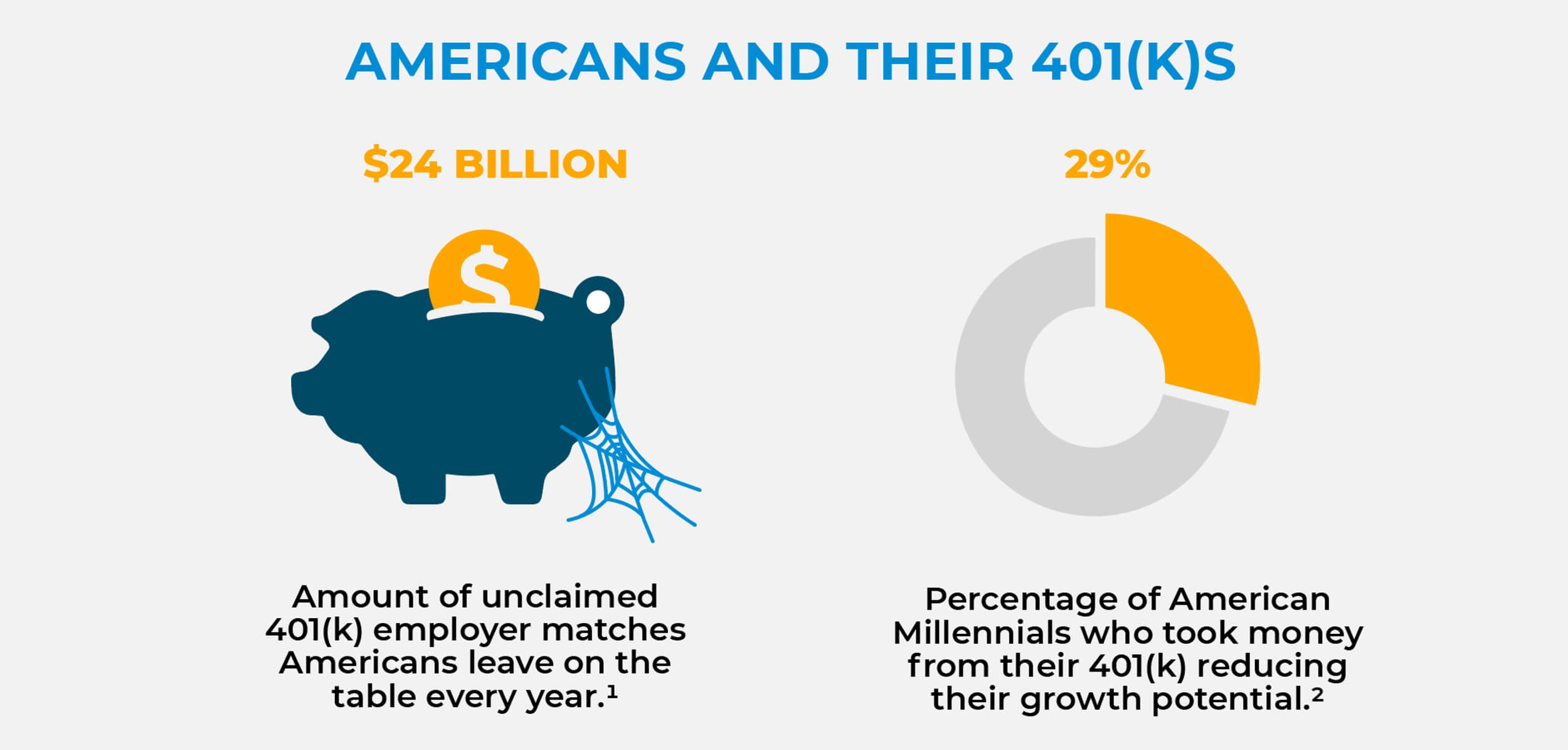

401(k)s are popular retirement savings vehicles, but many Americans don’t use them to their full advantage. Plus, if you’re asking if your 401(k) balance will be enough to live on in retirement, you may need to rethink the question. Instead, ask: Will my 401(k) be my only income stream in retirement beyond Social Security benefits? If you answered yes, you should probably explore more options. That’s because your 401(k) funds may have to last two decades or more. So make the most of your 401(k), but consider other retirement income solutions, too. Annuities, for instance, provide protected lifetime income and can supplement your retirement accounts.

1 Financial Engines, “Missing out: How much employer 401(k) matching contributions do employees leave on the table?”

2 Bank of the West, “2018 Millennial Study”

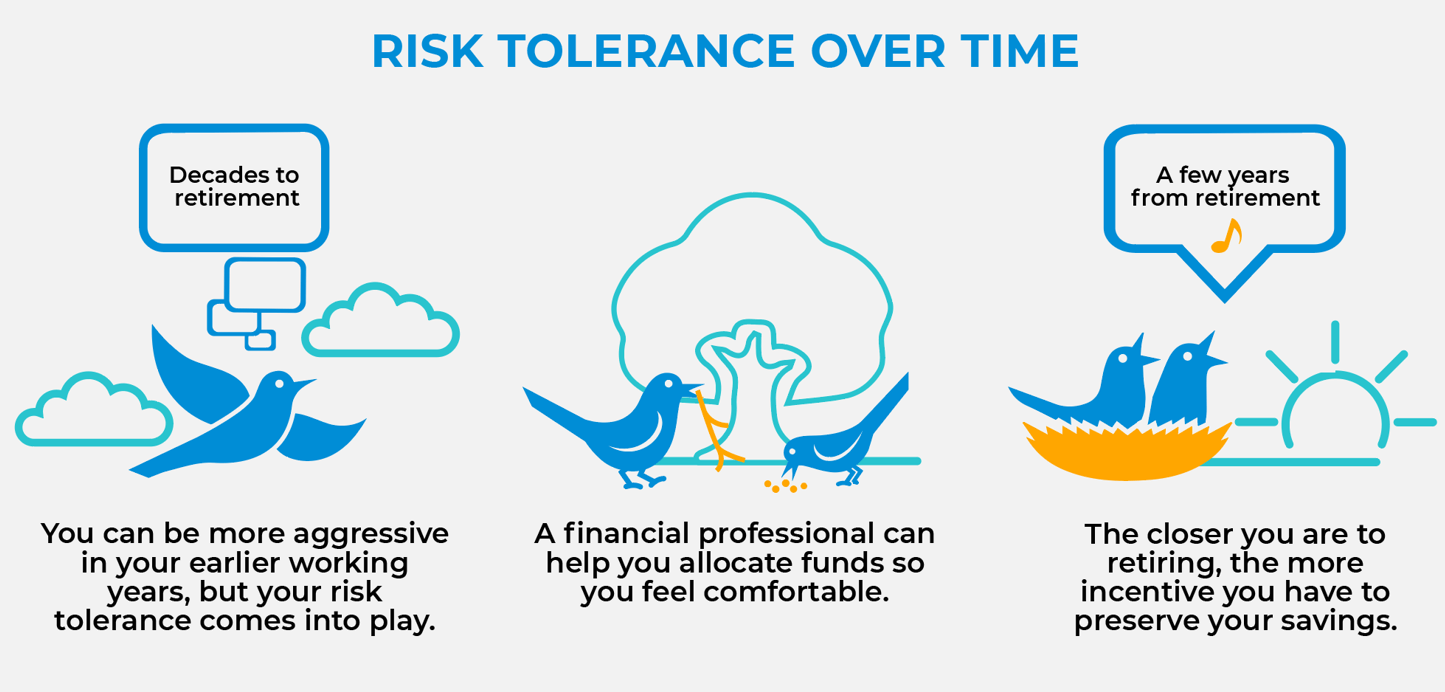

We all have different levels of risk we are willing to take on, and while your risk tolerance may not change much, your time horizon to retirement does. No matter where you fall on the risk tolerance spectrum, a financial professional can help guide you based on how far—or close—you are to retirement. They can help create a plan that balances your risk tolerance with your time horizon in order to achieve potential growth and preserve your retirement savings. In the meantime, assess your risk tolerance with our calculator.

As the length of retirement increases, so does the amount you'll need to live comfortably in those years.

View our infographic for interesting facts & figures about retirement.

A variable annuity is designed to provide reliable monthly income that lasts for life. It is a long-term investment that can help you grow your retirement savings faster by investing in a diverse selection of investment options while deferring taxes until you take income. The market-based investment performance will be variable, meaning it can go up or down. Variable annuities also allow you to provide for loved ones through a guaranteed death benefit.

A fixed indexed annuity is designed to provide reliable monthly income that lasts for life. It protects your principal, while providing growth opportunity based on the positive movement of an index, such as the S&P 500® index. Fixed indexed annuities enable you to grow your retirement savings faster by deferring taxes until you take income, creating lifetime income, and providing for loved ones through a guaranteed death benefit.

Offers death benefit protection with tax deferred cash value build up, and ability to access the cash value via policy loans and withdrawals.

A fixed, deferred income annuity is designed to provide reliable income that begins in the future, on a date that you choose. With it, you can tailor income to fit your needs and create income that lasts for life.

For you, family is one of the most important things in your life. You take care of them. They take care of you. Making sure that they’ll always be taken care of, no matter what happens.

LEARN MORE

You don’t know what the future has planned for you, but you want to be prepared for the unexpected and be able to achieve your goals.

LEARN MORE

You want your business to maintain its competitive edge. Attracting talent and building a succession plan for the future means you can ensure your business stays in stable hands.

LEARN MOREFor you, family is one of the most important things in your life. You take care of them. They take care of you. Making sure that they’ll always be taken care of, no matter what happens.

LEARN MOREYou don’t know what the future has planned for you, but you want to be prepared for the unexpected and be able to achieve your goals.

LEARN MOREYou want your business to maintain its competitive edge. Attracting talent and building a succession plan for the future means you can ensure your business stays in stable hands.

LEARN MOREIn order to sell life insurance, a financial professional must be a properly licensed and appointed life insurance producer.

Life Insurance is subject to underwriting and approval of the application and will incur monthly policy charges.

For tax-free death benefit proceeds: For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2)(i.e. the transfer-for-value rule); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

For tax-free distribution: For federal income tax purposes, tax-free income assumes, among other things: (1) withdrawals do not exceed tax basis (generally, premiums paid less prior withdrawals); (2) policy remains in force until death (any outstanding policy debt at time of lapse or surrender that exceeds the tax basis will be subject to tax); (3) withdrawals taken during the first 15 policy years do not cause, occur at the time of, or during the two years prior to, any reduction in benefits; and (4) the policy does not become a modified endowment contract. See IRC §§ 72, 7702(f)(7)(B), 7702A. Any policy withdrawals, loans and loan interest will reduce policy values and may reduce benefits.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not protect the value of the variable investment options, which are subject to market risk.

Pacific Life, its distributors, and respective representatives do not provide tax, accounting, or legal advice. Any taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor or attorney.

Annuity withdrawals and other distributions of taxable amounts, including death benefit payouts, will be subject to ordinary income tax. For nonqualified contracts, an additional 3.8% federal tax may apply on net investment income. If withdrawals and other distributions are taken prior to age 59½, an additional 10% federal tax may apply. A withdrawal charge and a market value adjustment (MVA) also may apply. Withdrawals will reduce the contract value and the value of the death benefits, and also may reduce the value of any optional benefits.

Under current law, a nonqualified annuity that is owned by an individual is generally entitled to tax deferral. IRAs and qualified plans—such as 401(k)s and 403(b)s—are already tax‑deferred. Therefore, a deferred annuity should be used only to fund an IRA or qualified plan to benefit from the annuity’s features other than tax deferral. These include lifetime income and death benefit options.

All investing involves risk, including the possible loss of the principal amount invested. The value of the variable investment options will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please see the prospectus for a detailed description of investment risks.

The "S&P 500® index" is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Pacific Life Insurance Company. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Pacific Life’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® index. . The index is not available for direct investment, and index performance does not include the reinvestment of dividends.

Pacific Life refers to Pacific Life Insurance Company and its affiliates, including Pacific Life & Annuity Company. Insurance products are issued by Pacific Life Insurance Company in all states except New York and in New York by Pacific Life & Annuity Company. Product availability and features may vary by state. Each insurance company is solely responsible for the financial obligations accruing under the products it issues.

Pacific Life's Home Office is located in Newport Beach, CA.

PL1.3C